Returns FAQs

View Detailed SafeSend Tax Payments Guide

Taxpayer FAQ

Is it safe to enter my social security number (SSN)?

Yes, look for HTTPS:// at the beginning of the site URL and a locked padlock symbol in your browser’s URL bar to confirm you are on a secure site. For more information about product security, see SafeSend’s Information Security Overview.

After signing, will I receive confirmation that the return was successfully submitted?

Yes, you will receive an email stating it was successful.

Will I receive a notification when my return is ready to sign?

Yes, email notifications regarding your return will be sent from noreply@safesendreturns.com.

Can I set up reminders for my quarterly estimated payment?

Yes, you can do this from the Pay screen. See the Pay Screen section of the Client Experience article for more information.

If a Partner/Shareholder declines to e-sign the K-1 how will I know?

The K-1 Distribution Page will show “Declined Consent”. If they happen to decline by accident you can click “Resend” to allow them to accept and download. See the K-1 Distribution article for more information.

I’d rather print and sign my e-file authorization form(s) – Can I do that?

Yes, select the Manually Sign button in the Sign section of your return. See the Manual Sign section of the Client Experience article for more information.

What if I don’t receive an email with my access code?

See the Access Codes Explained article for troubleshooting steps.

My Spouse and I are filing our return jointly – How can we both sign the e-file authorization form(s)?

The firm will send the return to one spouse first, who will complete signing and send the return to the second spouse. See the Client Experience article for more information.

Will I have the option to download and print my return to retain for my records?

Yes, you can do so during the Review step of the SafeSend Returns process and after signing is completed. See the Client Experience article for more information.

What browsers are currently supported?

Google Chrome (preferred), Firefox, Edge and Safari are all compatible with SafeSend Returns. Internet Explorer is no longer supported by Microsoft, which can cause issues/errors.

Can I choose to print and sign my e-file form(s)?

Yes, during the Sign step you can choose to e-sign or manually sign. See the Sign Tax Documents section of the Client Experience article for more information.

Access Codes Explained

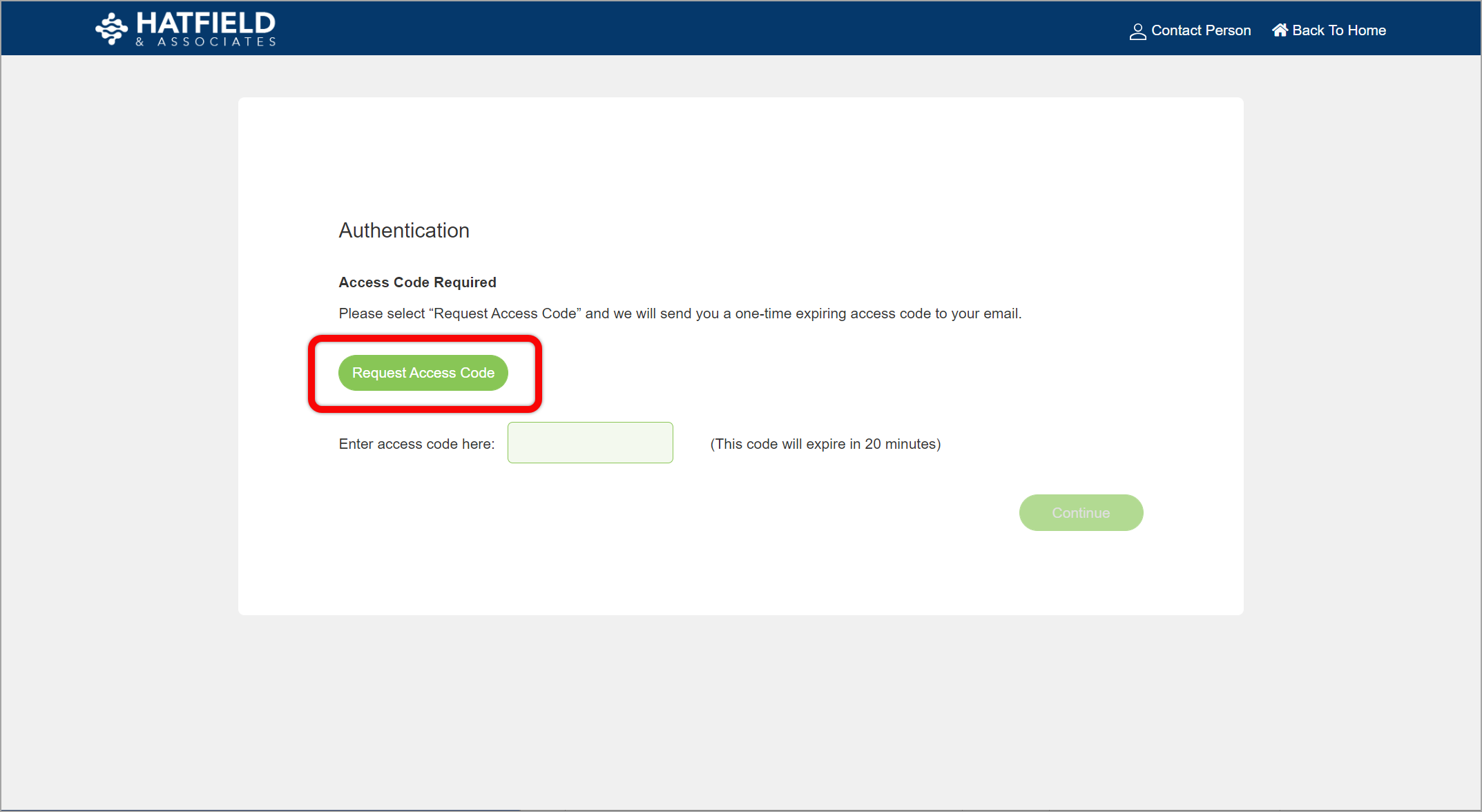

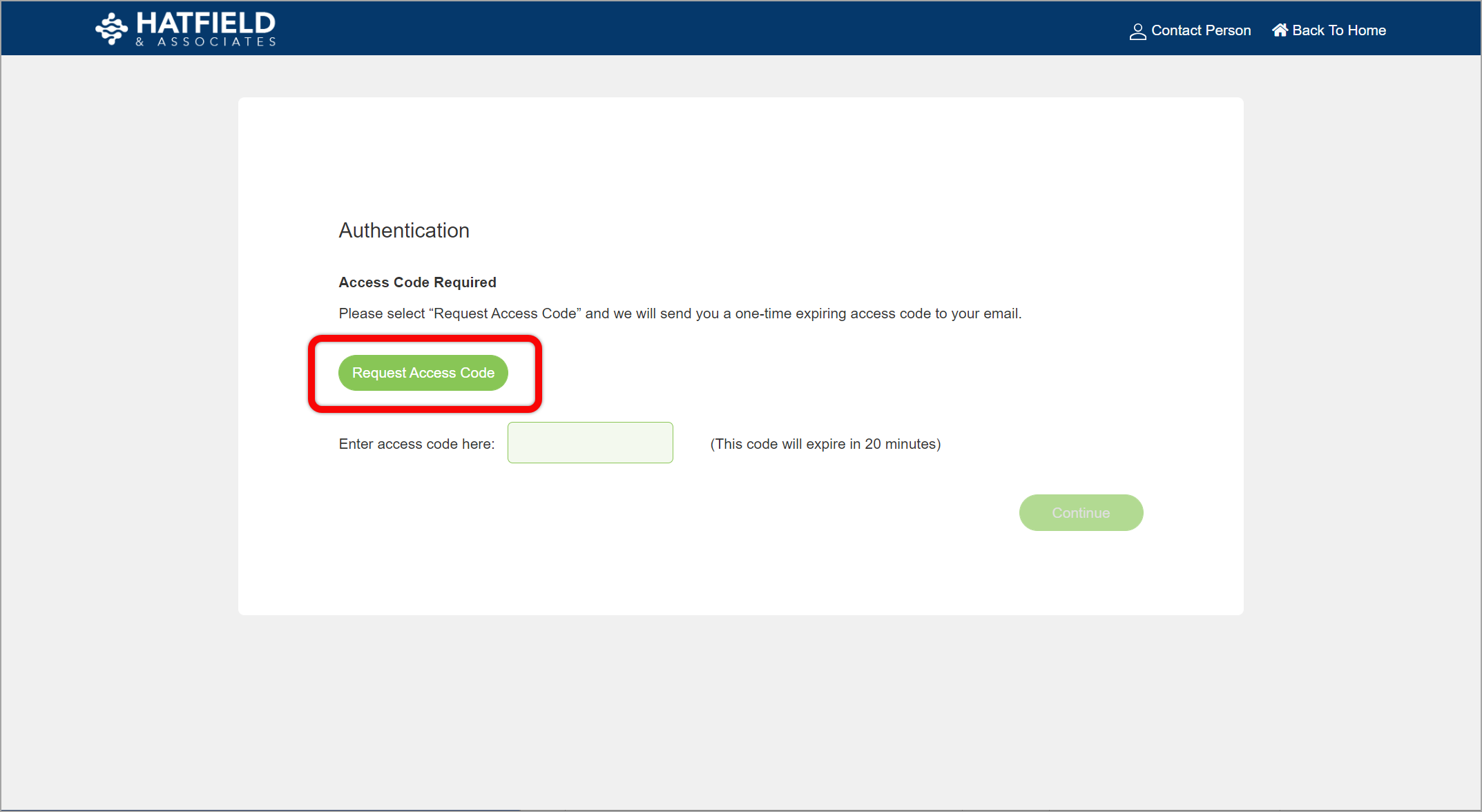

SafeSend requires taxpayers to enter an access code before viewing their returns. This security feature ensures the return is accessed only by the appropriate parties. Access codes are randomly generated and delivered via mobile text messages or email.

Important

-

- Access codes are randomly generated and will be valid for 20 minutes. After this time, you will be prompted to request a new code.

- Access codes are for one-time use only. Whenever you exit a return and go back to it, you will be prompted to request a new code.

What determines delivery via an email or a mobile text message?

Access codes are sent via mobile text message or email depending on the taxpayer information on file at the firm. The access code is sent via mobile text message if the taxpayer information contains a mobile phone number. If a mobile phone number is unavailable, the access code is sent via email.

Can a taxpayer add a mobile number to their profile?

Yes. While accessing your return, you can go to your profile menu and select My Account. You can then enter a mobile phone number.

What if you don’t receive an access code?

-

- Access codes can take up to 5 minutes to arrive. Don’t be alarmed if it doesn’t immediately get sent to you.

- Access codes are only sent via mobile text message if that information is on file with your tax preparer. Check the email address you use with the firm to see if a code was sent there.

- Emailed access codes come from noreply@safesendreturns.com. Make sure that the code was not filed in a junk or spam folder. Add our email addresses to your contact list, or mark it as safe, to ensure you are getting the proper messages.

- If you have an IT department in charge of your email address, check with them to ensure your emails are not being quarantined.

- When accessing your return, make sure you use a modern web browser such as Google Chrome, Mozilla Firefox, Safari, or Microsoft Edge. Older browsers may not work correctly when requesting an access code.

- If the code is going to their mobile device, ensure their service provider is not experiencing outages.

If you still can’t receive an access code after checking the items above, your tax preparer can generate one for you.

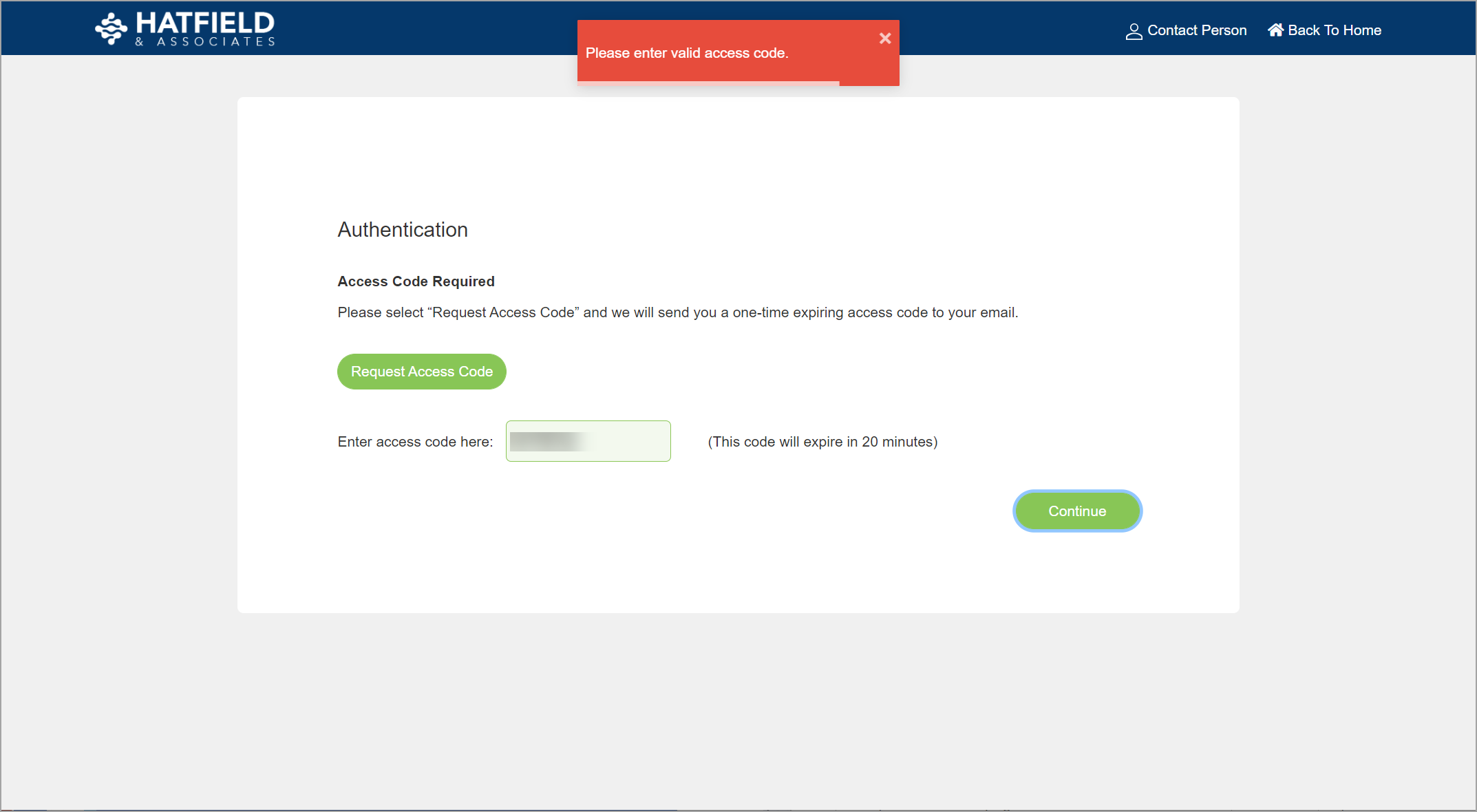

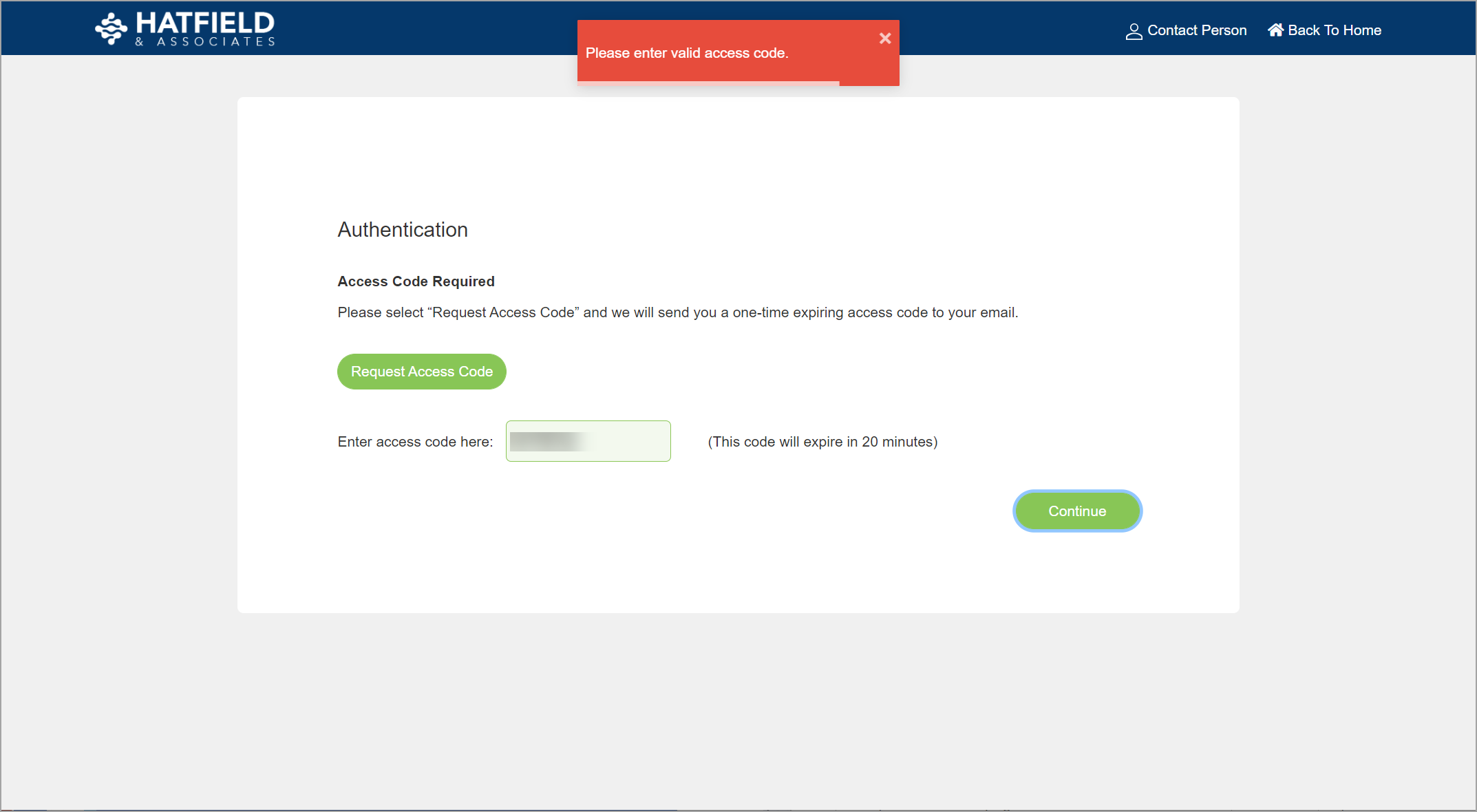

What if you receive an error when entering an access code?

-

- Access codes are only valid for 20 minutes and can only be used once. After that time, or if you previously accessed a return with that code, you will need to request a new one.

- If you enter an incorrect access code more than 3 times, your return will be locked. You will need to contact your tax preparer to unlock your return.

What if you receive an access code you did not request?

If multiple codes are received in a short period of time, it is possible the request button was accidentally clicked several times.

If you receive an access code you did not request, this indicates another party has the access link and requested a code. The access code process has alerted you that someone else may be accessing the return.

If the code was sent to a mobile device, the other party will not be able to view the code and will not be able to gain access to the return.

If the code was sent to an email address, the other party may have access to the code if your email has been compromised. In this case, you should contact the firm that prepared your return.

The return should be recalled to render the link invalid. The return can then be delivered to a different email address.

Knowledge-Based Authentication (KBA) Question Generation

SafeSend allows firms to use Knowledge-Based Authentication (KBA) questions to verify a taxpayer’s identity before granting access to sensitive information. In certain cases, the IRS requires it. These questions come from an integration with LexisNexis, a global provider of legal, regulatory, and business analytics.

Do other companies besides SafeSend use KBA questions?

Yes. KBA questions are a standard industry practice frequently used by banks and other financial service companies. The data used to generate those questions comes from various public record sources including credit report agencies, rideshare services, and cellphone providers. LexisNexis pools its data from over 400 different sources.

Important

SafeSend does not control which sources LexisNexis uses, nor can we change any questions or answers that are a part of the KBA process. Individuals must file a dispute with LexisNexis directly to correct any information. Visit the LexisNexis Risk Solutions Consumer Portal to learn how to request a copy of your identity report and how to raise a dispute.

When SafeSend displays KBA questions, does that affect a person’s credit score?

No. While LexisNexis receives information from credit reporting agencies, they do not perform a credit pull. LexisNexis updates its databases frequently to get updated information from all of their sources. It is important to note that using KBA questions does not affect a taxpayer’s credit score in any way.

What is the process to pass KBA Verification?

The taxpayer will be asked a series of 5 questions. They need to answer 3 out of 5 correctly. If they are unable to answer 3 out of 5 correctly another series of 5 questions will be presented. The taxpayer will have a total of 3 series of questions to answer 3 out of 5 correctly. If they fail all 3 series, SafeSend Returns will mandate the taxpayer to download the E-sign forms and manually sign per IRS guidelines.

What are “Red Herring” KBA questions?

As an added level of security, LexisNexis uses what are called “Red Herring” questions. These are questions that are designed to trick any fraudulent attempts but which the legitimate taxpayer would recognize as nonsensical and answer none of the above. These questions are also added more frequently to those taxpayers who have a small number of public records. This is needed to generate enough questions to achieve 3 out of 5 correct answers.

Is it safe to enter my social security number (SSN)?

Yes, look for HTTPS:// at the beginning of the site URL and a locked padlock symbol in your browser’s URL bar to confirm you are on a secure site. For more information about product security, see SafeSend’s Information Security Overview.

After signing, will I receive confirmation that the return was successfully submitted?

Yes, you will receive an email stating it was successful.

Will I receive a notification when my return is ready to sign?

Yes, email notifications regarding your return will be sent from noreply@safesendreturns.com.

Can I set up reminders for my quarterly estimated payment?

Yes, you can do this from the Pay screen. See the Pay Screen section of the Client Experience article for more information.

If a Partner/Shareholder declines to e-sign the K-1 how will I know?

The K-1 Distribution Page will show “Declined Consent”. If they happen to decline by accident you can click “Resend” to allow them to accept and download. See the K-1 Distribution article for more information.

I’d rather print and sign my e-file authorization form(s) – Can I do that?

Yes, select the Manually Sign button in the Sign section of your return. See the Manual Sign section of the Client Experience article for more information.

What if I don’t receive an email with my access code?

See the Access Codes Explained article for troubleshooting steps.

My Spouse and I are filing our return jointly – How can we both sign the e-file authorization form(s)?

The firm will send the return to one spouse first, who will complete signing and send the return to the second spouse. See the Client Experience article for more information.

Will I have the option to download and print my return to retain for my records?

Yes, you can do so during the Review step of the SafeSend Returns process and after signing is completed. See the Client Experience article for more information.

What browsers are currently supported?

Google Chrome (preferred), Firefox, Edge and Safari are all compatible with SafeSend Returns. Internet Explorer is no longer supported by Microsoft, which can cause issues/errors.

Can I choose to print and sign my e-file form(s)?

Yes, during the Sign step you can choose to e-sign or manually sign. See the Sign Tax Documents section of the Client Experience article for more information.

Yes, look for HTTPS:// at the beginning of the site URL and a locked padlock symbol in your browser’s URL bar to confirm you are on a secure site. For more information about product security, see SafeSend’s Information Security Overview.

Yes, you will receive an email stating it was successful.

Yes, email notifications regarding your return will be sent from noreply@safesendreturns.com.

Yes, you can do this from the Pay screen. See the Pay Screen section of the Client Experience article for more information.

The K-1 Distribution Page will show “Declined Consent”. If they happen to decline by accident you can click “Resend” to allow them to accept and download. See the K-1 Distribution article for more information.

Yes, select the Manually Sign button in the Sign section of your return. See the Manual Sign section of the Client Experience article for more information.

See the Access Codes Explained article for troubleshooting steps.

The firm will send the return to one spouse first, who will complete signing and send the return to the second spouse. See the Client Experience article for more information.

Yes, you can do so during the Review step of the SafeSend Returns process and after signing is completed. See the Client Experience article for more information.

Google Chrome (preferred), Firefox, Edge and Safari are all compatible with SafeSend Returns. Internet Explorer is no longer supported by Microsoft, which can cause issues/errors.

Yes, during the Sign step you can choose to e-sign or manually sign. See the Sign Tax Documents section of the Client Experience article for more information.

SafeSend requires taxpayers to enter an access code before viewing their returns. This security feature ensures the return is accessed only by the appropriate parties. Access codes are randomly generated and delivered via mobile text messages or email.

Important

-

- Access codes are randomly generated and will be valid for 20 minutes. After this time, you will be prompted to request a new code.

- Access codes are for one-time use only. Whenever you exit a return and go back to it, you will be prompted to request a new code.

What determines delivery via an email or a mobile text message?

Access codes are sent via mobile text message or email depending on the taxpayer information on file at the firm. The access code is sent via mobile text message if the taxpayer information contains a mobile phone number. If a mobile phone number is unavailable, the access code is sent via email.

Can a taxpayer add a mobile number to their profile?

Yes. While accessing your return, you can go to your profile menu and select My Account. You can then enter a mobile phone number.

What if you don’t receive an access code?

-

- Access codes can take up to 5 minutes to arrive. Don’t be alarmed if it doesn’t immediately get sent to you.

- Access codes are only sent via mobile text message if that information is on file with your tax preparer. Check the email address you use with the firm to see if a code was sent there.

- Emailed access codes come from noreply@safesendreturns.com. Make sure that the code was not filed in a junk or spam folder. Add our email addresses to your contact list, or mark it as safe, to ensure you are getting the proper messages.

- If you have an IT department in charge of your email address, check with them to ensure your emails are not being quarantined.

- When accessing your return, make sure you use a modern web browser such as Google Chrome, Mozilla Firefox, Safari, or Microsoft Edge. Older browsers may not work correctly when requesting an access code.

- If the code is going to their mobile device, ensure their service provider is not experiencing outages.

If you still can’t receive an access code after checking the items above, your tax preparer can generate one for you.

What if you receive an error when entering an access code?

-

- Access codes are only valid for 20 minutes and can only be used once. After that time, or if you previously accessed a return with that code, you will need to request a new one.

- If you enter an incorrect access code more than 3 times, your return will be locked. You will need to contact your tax preparer to unlock your return.

What if you receive an access code you did not request?

If multiple codes are received in a short period of time, it is possible the request button was accidentally clicked several times.

If you receive an access code you did not request, this indicates another party has the access link and requested a code. The access code process has alerted you that someone else may be accessing the return.

If the code was sent to a mobile device, the other party will not be able to view the code and will not be able to gain access to the return.

If the code was sent to an email address, the other party may have access to the code if your email has been compromised. In this case, you should contact the firm that prepared your return.

The return should be recalled to render the link invalid. The return can then be delivered to a different email address.

SafeSend allows firms to use Knowledge-Based Authentication (KBA) questions to verify a taxpayer’s identity before granting access to sensitive information. In certain cases, the IRS requires it. These questions come from an integration with LexisNexis, a global provider of legal, regulatory, and business analytics.

Do other companies besides SafeSend use KBA questions?

Yes. KBA questions are a standard industry practice frequently used by banks and other financial service companies. The data used to generate those questions comes from various public record sources including credit report agencies, rideshare services, and cellphone providers. LexisNexis pools its data from over 400 different sources.

Important

SafeSend does not control which sources LexisNexis uses, nor can we change any questions or answers that are a part of the KBA process. Individuals must file a dispute with LexisNexis directly to correct any information. Visit the LexisNexis Risk Solutions Consumer Portal to learn how to request a copy of your identity report and how to raise a dispute.

When SafeSend displays KBA questions, does that affect a person’s credit score?

No. While LexisNexis receives information from credit reporting agencies, they do not perform a credit pull. LexisNexis updates its databases frequently to get updated information from all of their sources. It is important to note that using KBA questions does not affect a taxpayer’s credit score in any way.

What is the process to pass KBA Verification?

The taxpayer will be asked a series of 5 questions. They need to answer 3 out of 5 correctly. If they are unable to answer 3 out of 5 correctly another series of 5 questions will be presented. The taxpayer will have a total of 3 series of questions to answer 3 out of 5 correctly. If they fail all 3 series, SafeSend Returns will mandate the taxpayer to download the E-sign forms and manually sign per IRS guidelines.

What are “Red Herring” KBA questions?

As an added level of security, LexisNexis uses what are called “Red Herring” questions. These are questions that are designed to trick any fraudulent attempts but which the legitimate taxpayer would recognize as nonsensical and answer none of the above. These questions are also added more frequently to those taxpayers who have a small number of public records. This is needed to generate enough questions to achieve 3 out of 5 correct answers.

Organizer FAQs

Organizer FAQ

Which file types can I upload?

You can upload pdf, .doc, .xls, .txt, .png and .jpeg files.

Can I edit my organizer after it’s been submitted as complete?

Yes, the firm would need to unlock the organizer for you. Please contact Slattery & Holman for assistance.

When can I upload additional documents?

If you marked the document uploads as complete, additional documents cannot be uploaded. The firm can allow uploads again by reopening document upload. Please contact Slattery & Holman for assistance.

Can I fill out my organizer on a tablet?

Yes, the organizer can be completed on a tablet. This includes signing, completing the questionnaire, filling out the organizer, and uploading documents.

Can I fill out my organizer on a phone?

Organizers can be partially completed on a phone. You can sign and upload documents, but you cannot complete the questionnaire or fill out the organizer on a mobile device. See the Organizers on Mobile article for more information.

Why are all the options to sign and fill grayed out?

This indicates that your spouse must sign the engagement letter before you can continue.

Married Filing Jointly Organizers

There are several scenarios in which the organizer is delivered only to the taxpayer, delivered to the taxpayer and spouse at the same time, or delivered to the taxpayer first, then the spouse.

What happens depends on what email addresses are entered during processing, if a signature is required for the spouse, and what actions the taxpayer takes. These situations are outlined below.

Taxpayer Email Only – No Spouse Signature Required

If an email address is only entered for the taxpayer during processing, and there is no signature control in place for the spouse, the organizer is only delivered to the taxpayer.

The taxpayer can click Finish > Send For Review to be prompted to enter an email address for the spouse. Once the email address is confirmed, the organizer link is delivered to the spouse.

If the taxpayer clicks Finish > Organizer Complete, the spouse does not receive an access link and the organizer can no longer be edited.

Taxpayer Email Only – Spouse Signature Required

If an email address is only entered for the taxpayer during processing, and there is at least one signature control in place for the spouse, the organizer is only delivered to the taxpayer initially.

Once the taxpayer completes signing, they are prompted to enter an email address for the spouse. Once the email address is confirmed, the organizer link is delivered to the spouse.

Taxpayer and Spouse Email Entered

If an email address is entered for the taxpayer and the spouse during processing, the organizer is delivered to both addresses at the same time.

During processing, you can choose who to deliver to first. This person is prompted to sign first and must complete signing before the second signer can sign.

Which file types can I upload?

You can upload pdf, .doc, .xls, .txt, .png and .jpeg files.

Can I edit my organizer after it’s been submitted as complete?

Yes, the firm would need to unlock the organizer for you. Please contact Slattery & Holman for assistance.

When can I upload additional documents?

If you marked the document uploads as complete, additional documents cannot be uploaded. The firm can allow uploads again by reopening document upload. Please contact Slattery & Holman for assistance.

Can I fill out my organizer on a tablet?

Yes, the organizer can be completed on a tablet. This includes signing, completing the questionnaire, filling out the organizer, and uploading documents.

Can I fill out my organizer on a phone?

Organizers can be partially completed on a phone. You can sign and upload documents, but you cannot complete the questionnaire or fill out the organizer on a mobile device. See the Organizers on Mobile article for more information.

Why are all the options to sign and fill grayed out?

This indicates that your spouse must sign the engagement letter before you can continue.

You can upload pdf, .doc, .xls, .txt, .png and .jpeg files.

Yes, the firm would need to unlock the organizer for you. Please contact Slattery & Holman for assistance.

If you marked the document uploads as complete, additional documents cannot be uploaded. The firm can allow uploads again by reopening document upload. Please contact Slattery & Holman for assistance.

Yes, the organizer can be completed on a tablet. This includes signing, completing the questionnaire, filling out the organizer, and uploading documents.

Organizers can be partially completed on a phone. You can sign and upload documents, but you cannot complete the questionnaire or fill out the organizer on a mobile device. See the Organizers on Mobile article for more information.

This indicates that your spouse must sign the engagement letter before you can continue.

There are several scenarios in which the organizer is delivered only to the taxpayer, delivered to the taxpayer and spouse at the same time, or delivered to the taxpayer first, then the spouse.

What happens depends on what email addresses are entered during processing, if a signature is required for the spouse, and what actions the taxpayer takes. These situations are outlined below.

Taxpayer Email Only – No Spouse Signature Required

If an email address is only entered for the taxpayer during processing, and there is no signature control in place for the spouse, the organizer is only delivered to the taxpayer.

The taxpayer can click Finish > Send For Review to be prompted to enter an email address for the spouse. Once the email address is confirmed, the organizer link is delivered to the spouse.

If the taxpayer clicks Finish > Organizer Complete, the spouse does not receive an access link and the organizer can no longer be edited.

Taxpayer Email Only – Spouse Signature Required

If an email address is only entered for the taxpayer during processing, and there is at least one signature control in place for the spouse, the organizer is only delivered to the taxpayer initially.

Once the taxpayer completes signing, they are prompted to enter an email address for the spouse. Once the email address is confirmed, the organizer link is delivered to the spouse.

Taxpayer and Spouse Email Entered

If an email address is entered for the taxpayer and the spouse during processing, the organizer is delivered to both addresses at the same time.

During processing, you can choose who to deliver to first. This person is prompted to sign first and must complete signing before the second signer can sign.