Make Voucher Payments

Access Return

1. Click the link that was emailed to you by Slattery & Holman, P.C. (using the email address noreply@safesendreturns.com)

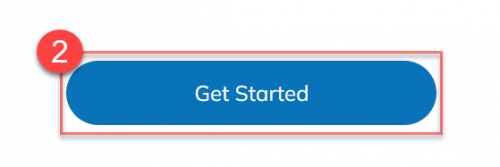

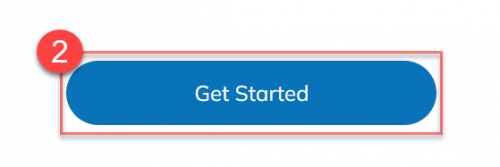

2. Click Get Started.

3. Click the Send Code button to receive an access code.

4. Enter the code that was sent to you via email or phone and click Confirm.

Make Tax Payments

1. Once you have access the return, you will select Make Tax Payments from the landing screen.

2. Select the Payment Type.

Note: The yearly tax payments and the next year’s estimates will be on different screens.

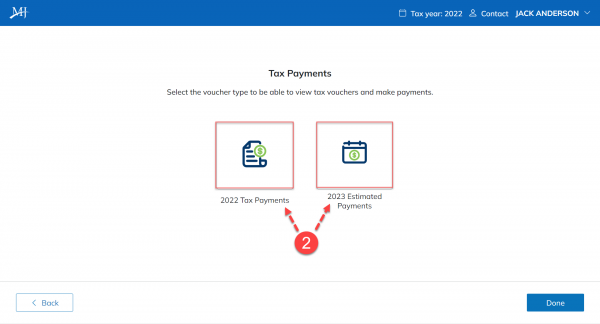

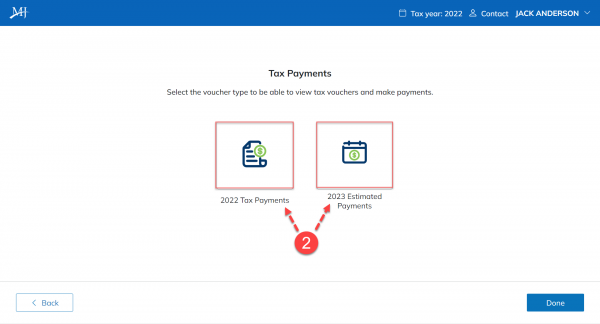

Payments Dashboard

Options available from either of the payment screens:

A. Click on each due date to see all payments due for that quarter.

B. Click Pay to open the payment options.

C. Click Add Payment Details to enter the information for the payment that was made.

D. Select the drop-down Email me reminder __ days before payment is due to customize the time frame that you will receive a reminder when you have a payment due.

E. Click Payment Voucher to download all payment vouchers.

F. Click Filing Instructions to download all the filing instructions.

G. Click Go To.. to go to the other payment section.

1. Click the link that was emailed to you by Slattery & Holman, P.C. (using the email address noreply@safesendreturns.com)

2. Click Get Started.

3. Click the Send Code button to receive an access code.

4. Enter the code that was sent to you via email or phone and click Confirm.

1. Once you have access the return, you will select Make Tax Payments from the landing screen.

2. Select the Payment Type.

Note: The yearly tax payments and the next year’s estimates will be on different screens.

Options available from either of the payment screens:

A. Click on each due date to see all payments due for that quarter.

B. Click Pay to open the payment options.

C. Click Add Payment Details to enter the information for the payment that was made.

D. Select the drop-down Email me reminder __ days before payment is due to customize the time frame that you will receive a reminder when you have a payment due.

E. Click Payment Voucher to download all payment vouchers.

F. Click Filing Instructions to download all the filing instructions.

G. Click Go To.. to go to the other payment section.

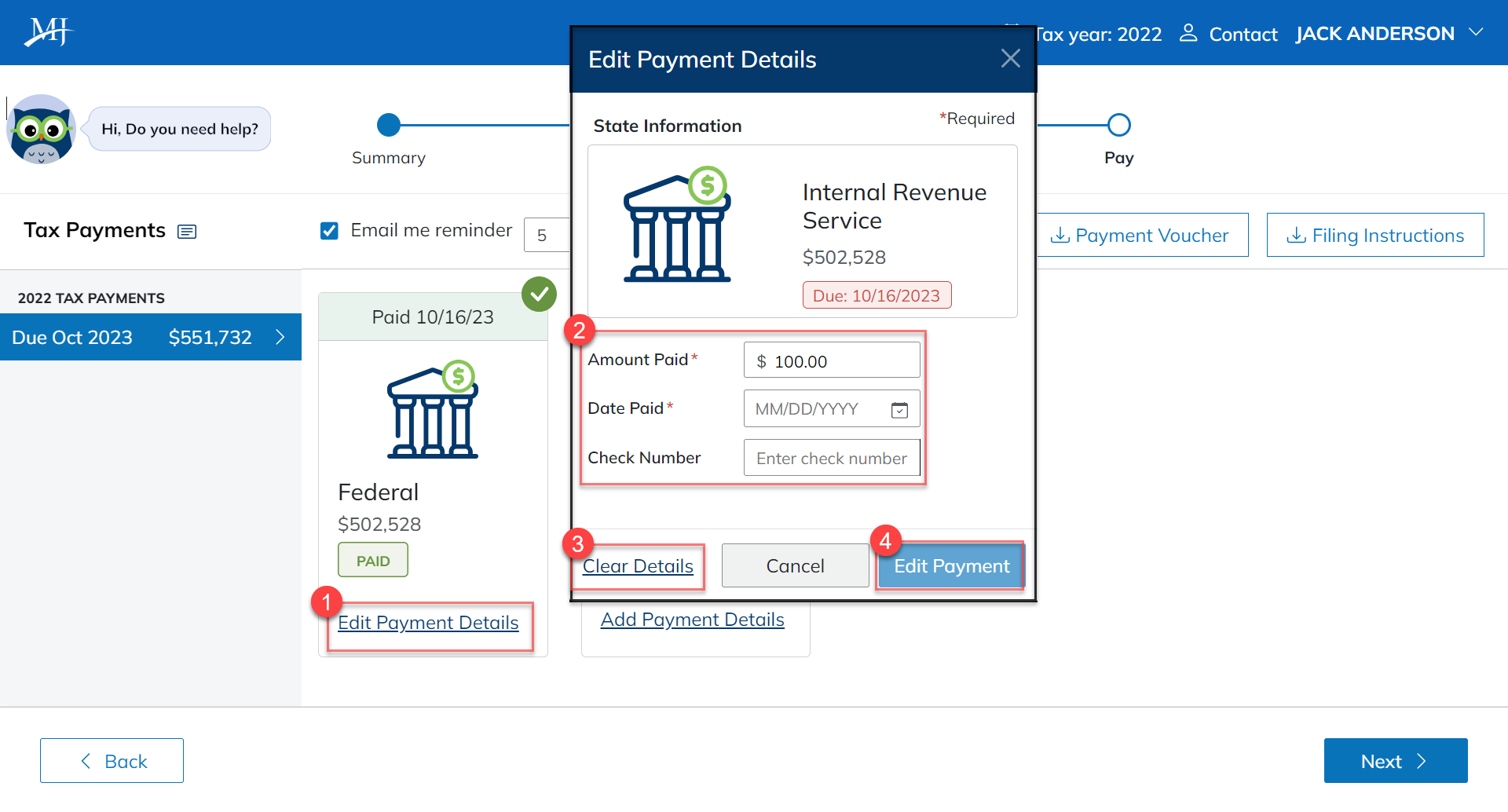

Edit / Clear Payment Details

Clients can mark vouchers and invoices as paid in the Pay Screen in order to halt reminders on the payment and keep track of which payments still need to be made. Clients can also edit any previously entered payments to reflect appropriate information if it needs to be updated.

Note

This is for record-keeping purposes only. Any information entered does not constitute payment, and will not process or confirm payment from the taxing authority.

Update or Remove Payment Details

1. Click the Update payment details.

2. Change the Amount Paid, Date Paid, or the Check Number as necessary.

3. Click Clear Details to empty out the payment details attached to the voucher.

4. Click Edit Payment to finalize your changes.

1. Click the Update payment details.

2. Change the Amount Paid, Date Paid, or the Check Number as necessary.

3. Click Clear Details to empty out the payment details attached to the voucher.

4. Click Edit Payment to finalize your changes.

Voucher Reminder Notifications

Taxpayers can receive email notifications reminding them to pay their vouchers before the payment is due. The ability to turn on payment reminders is a setting controlled by your tax professional. If they have this option enabled when delivering your return, you can choose when to receive reminders or turn them off completely.

Important

-

- Changing reminder settings for either tax payments or estimated payments affects both. You cannot have a different reminder setting for a tax payment date versus estimated payment dates.

- If the taxpayer turns off payment reminders they can only be re-enabled by the taxpayer, not by the firm.

Settings for Reminders

Settings for reminders appear on the Payment Details page for both tax payments and estimated payments.

-

- If you have not completed the signature process, the Payment Details page will appear as part of the signing process.

- If you have already completed your signature process and want to go back and change reminder settings, click on Make Tax Payments from the Summary page. You can then click on the tax payment or estimated payments buttons to be taken to the Payment Details page.

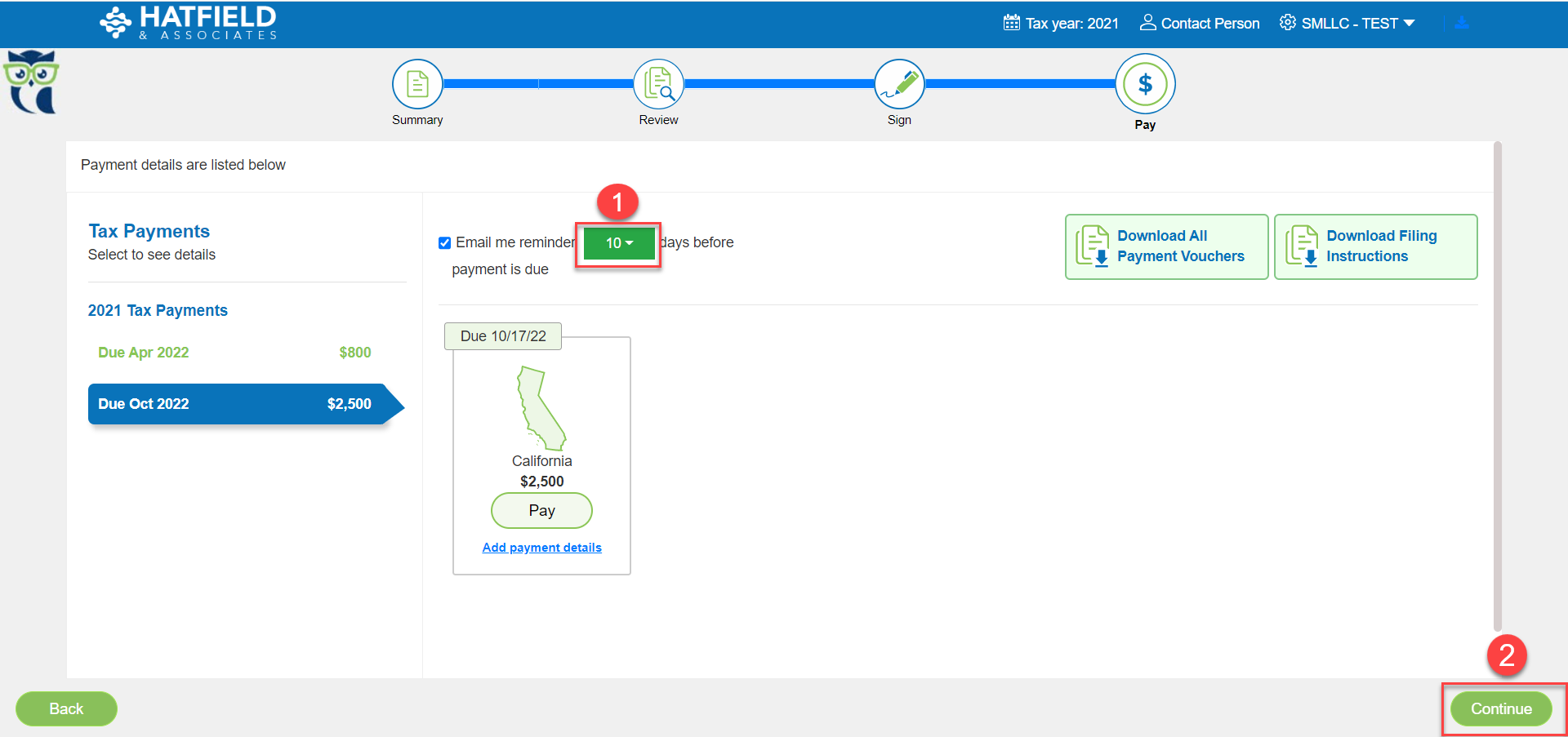

Change Voucher Reminder Dates

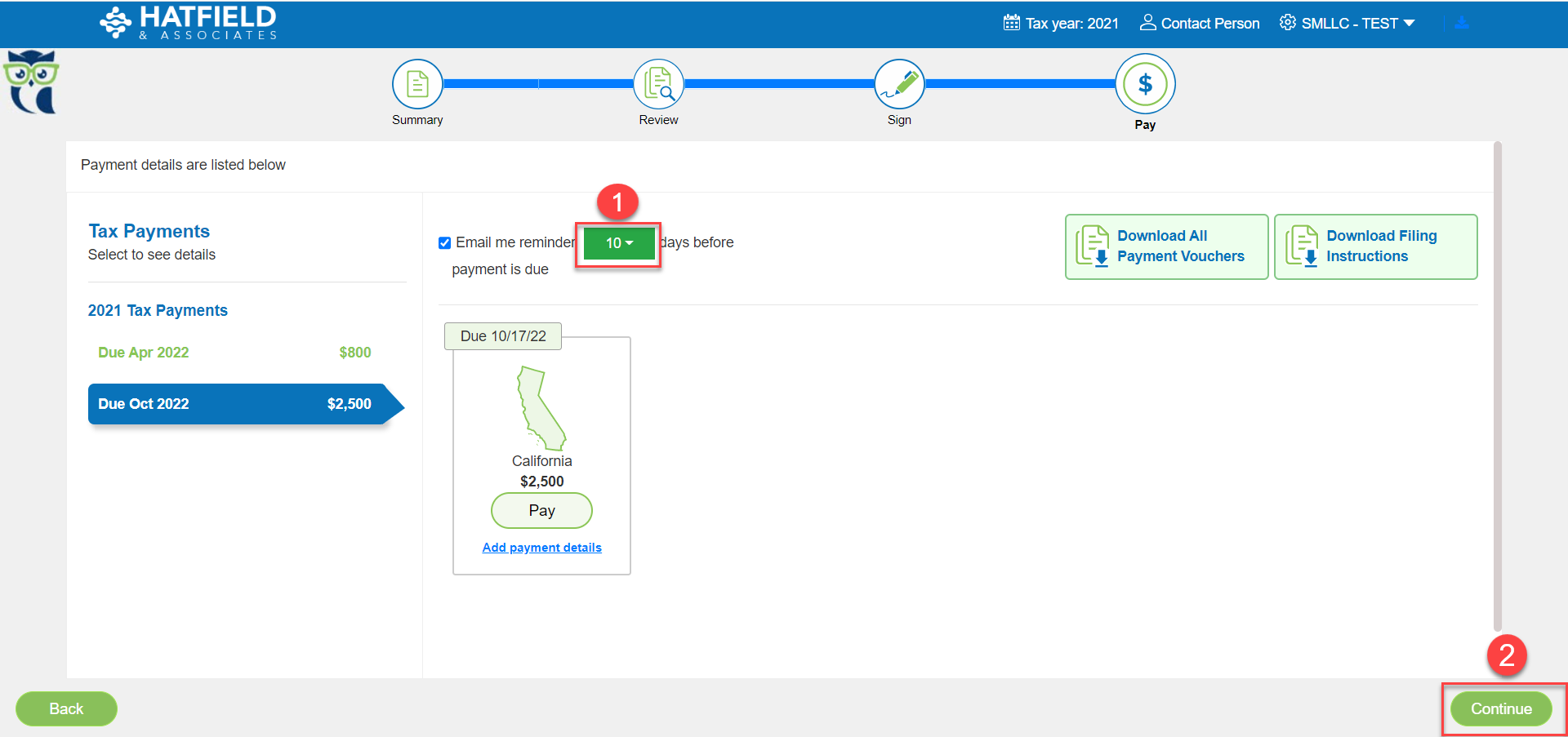

On the Payment Details page, above the payment buttons, is a section to control reminder settings.

1. Click on the drop-down menu to set the number of days before the payment due date to receive a reminder.

2. Click Continue to save your settings.

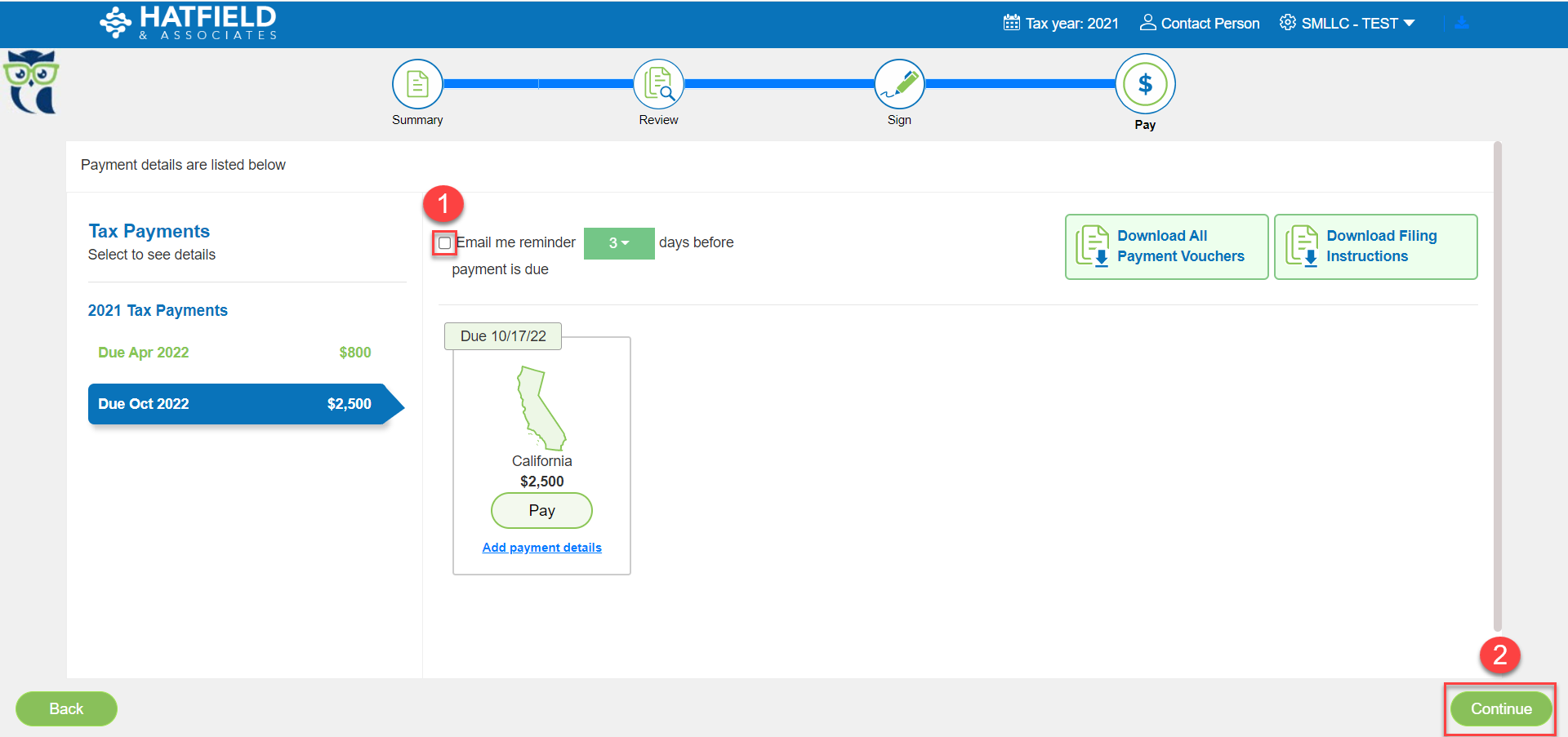

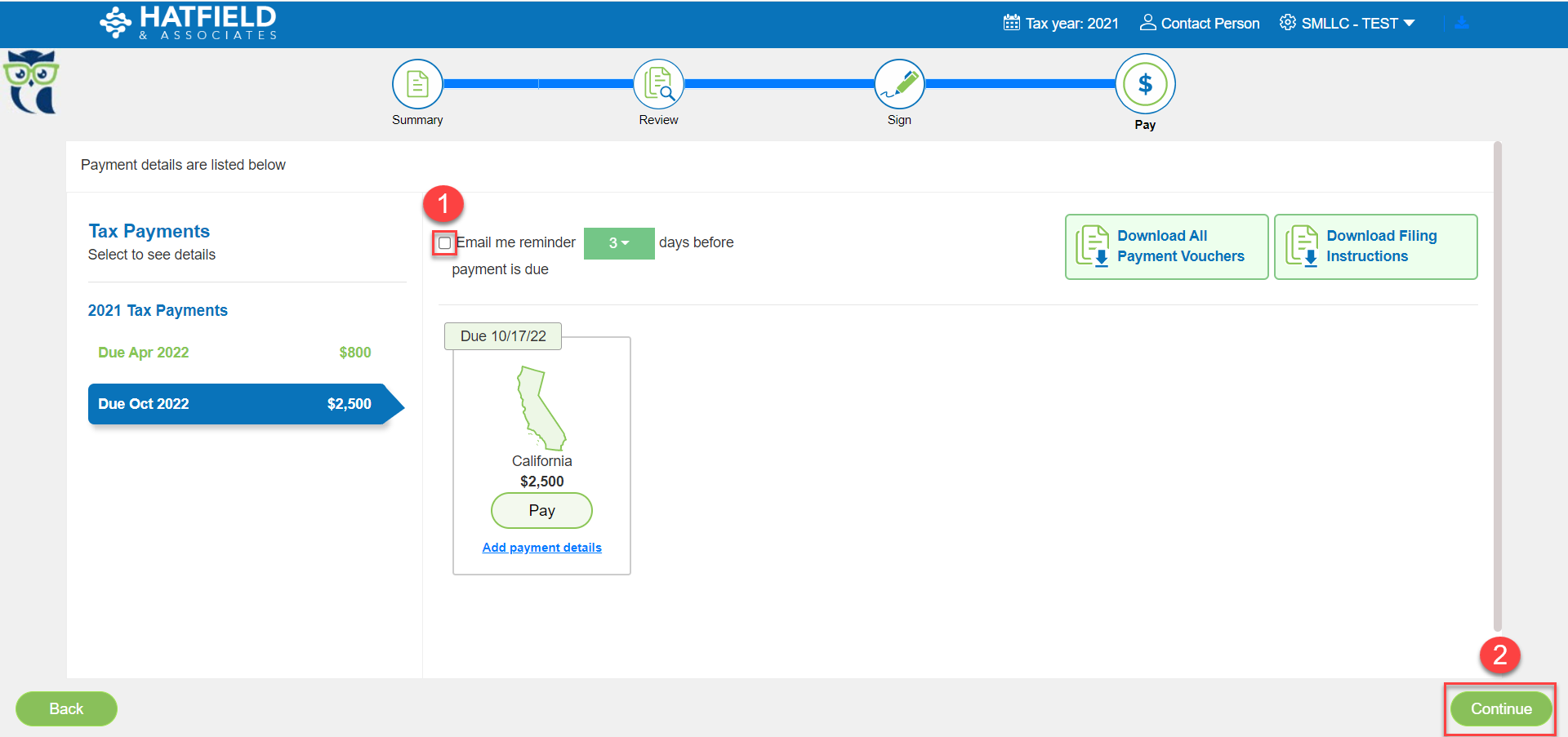

Disable Voucher Reminders

1. Click the checkbox next to Email me… to completely disable payment reminders. Remember: If you turn off reminders, only you can turn them on again. Your tax preparer cannot re-enable the reminders.

2. Click Continue to save your settings.

On the Payment Details page, above the payment buttons, is a section to control reminder settings.

1. Click on the drop-down menu to set the number of days before the payment due date to receive a reminder.

2. Click Continue to save your settings.

1. Click the checkbox next to Email me… to completely disable payment reminders. Remember: If you turn off reminders, only you can turn them on again. Your tax preparer cannot re-enable the reminders.

2. Click Continue to save your settings.

Voucher Reminder FAQs

Are voucher reminders only delivered once?

Voucher reminders are only delivered once for each due date.

If the taxpayer has 5 vouchers due on April 15th, they will only receive 1 email notification to pay these vouchers

What happens if past-date vouchers are delivered?

voucher reminder is delivered immediately after the return is delivered.

Who receives voucher reminders for married filing joint returns?

Voucher reminders are delivered to any recipient who has received the initial email to sign.

Example 1: If the taxpayer has completed signing, the taxpayer and spouse will receive a voucher reminder.

Example 2: If the taxpayer has not completed signing, only the taxpayer will receive a voucher reminder.

Who receives voucher reminders for Group returns? All reminders are sent to the controller.

Who receives voucher reminders for married filing joint returns?

Who received voucher reminders for Group returns?

Voucher reminders are only delivered once for each due date.

If the taxpayer has 5 vouchers due on April 15th, they will only receive 1 email notification to pay these vouchers

voucher reminder is delivered immediately after the return is delivered.

Who receives voucher reminders for married filing joint returns?

Voucher reminders are delivered to any recipient who has received the initial email to sign.

Example 1: If the taxpayer has completed signing, the taxpayer and spouse will receive a voucher reminder.

Example 2: If the taxpayer has not completed signing, only the taxpayer will receive a voucher reminder.

Who receives voucher reminders for Group returns? All reminders are sent to the controller.